|

One of the great movies of the 1990s was Paul Thomas Anderson’s “Boogie Nights,” the 1997 flick about the porn industry of the late 1970s/early 1980s.

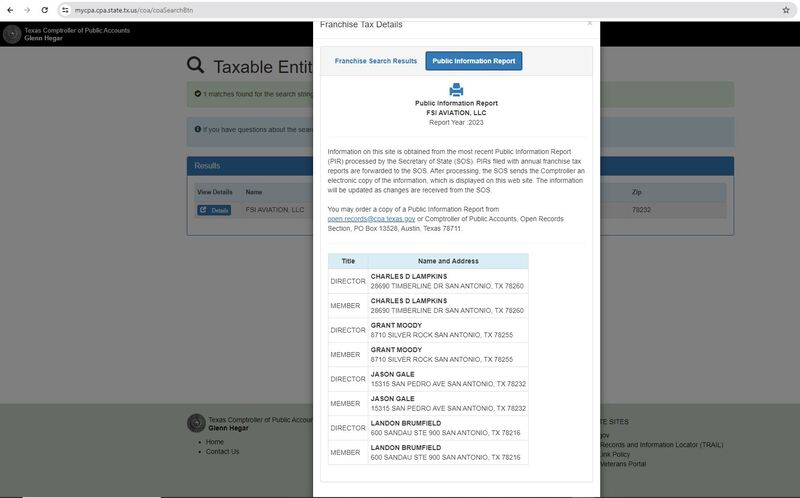

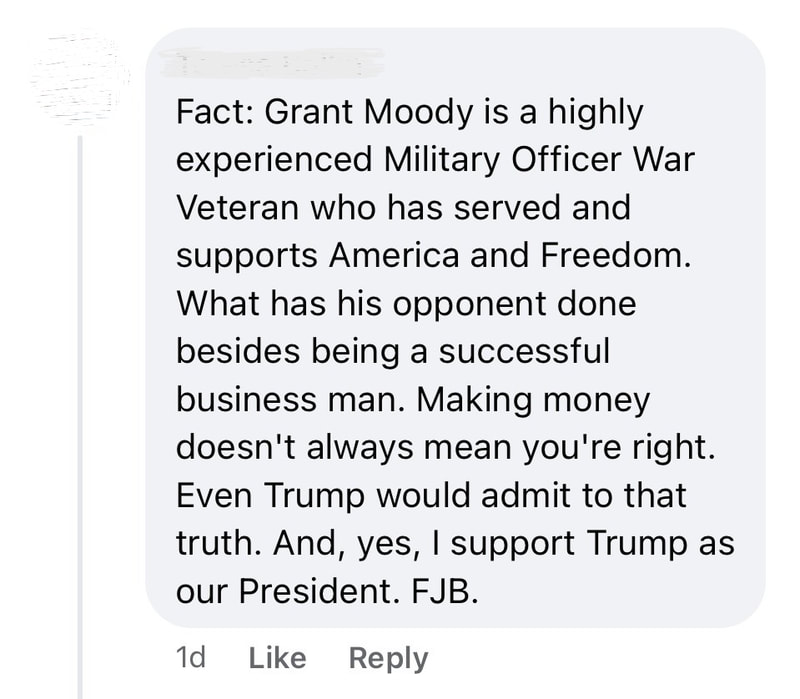

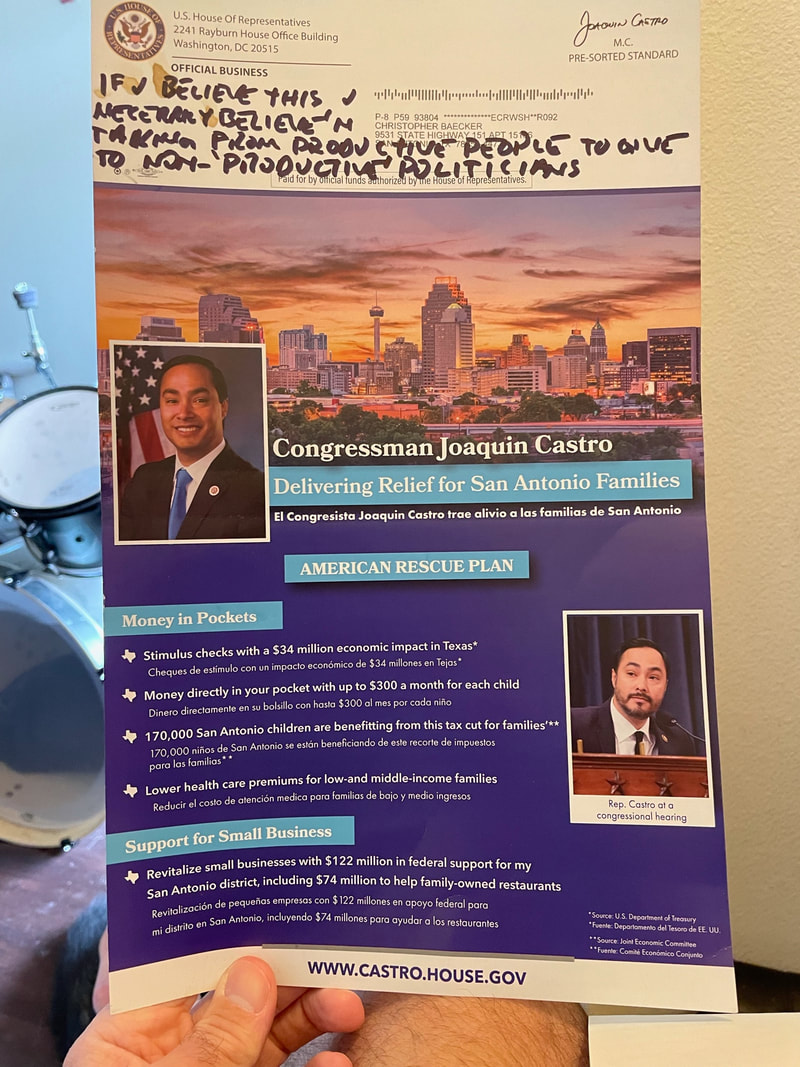

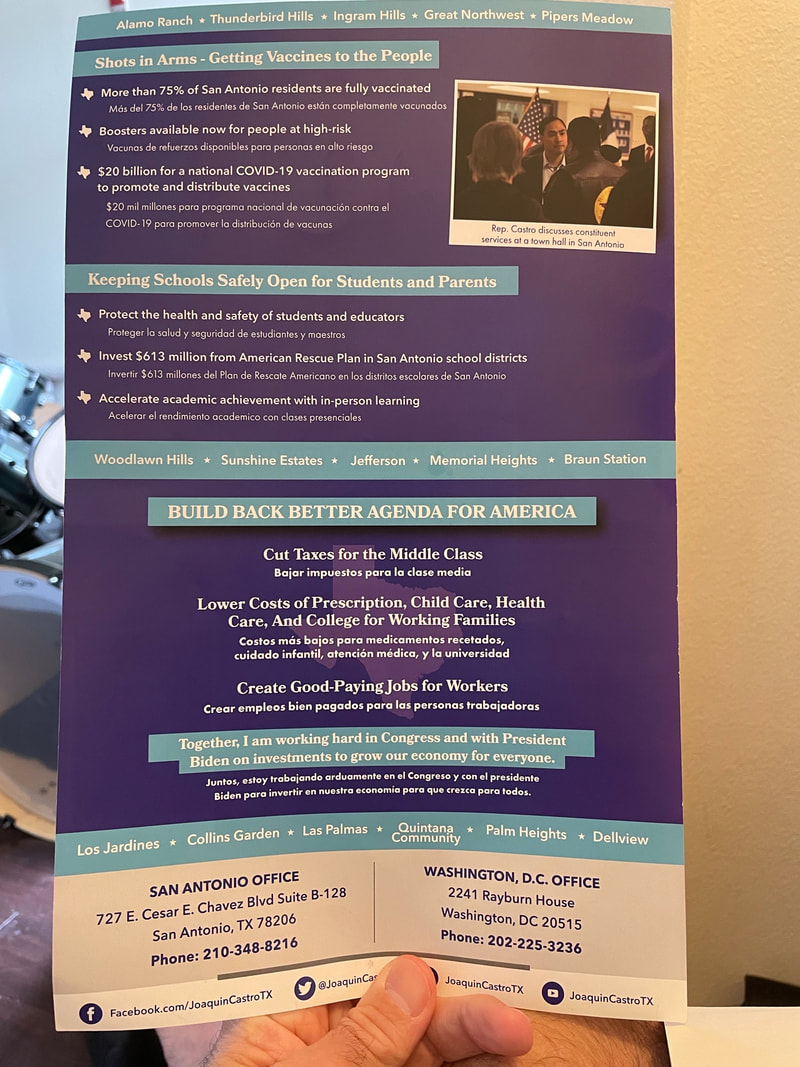

It’s always been a bit conflicting though, when you believe that the vast majority of nudity/sex we see in the movies is unnecessary. The point can be made without witnessing the exhibitionism on camera, and being a party to the voyeurism behind it. A similar dilemma comes to mind with Sarah Stogner. She’s running for the republican nomination for Texas Railroad Commissioner. With “primary regulatory jurisdiction,” this position holds considerable sway over the most Lone Star of industries: oil and gas. She does appear to have the chops for the gig. According to her campaign website, her law firm has helped “operators, service companies and landowners in complex legal disputes … for almost 15 years.” Apparently however, she doesn’t believe those credentials are bringing her campaign due attention. Last week it released a brief, dimly-lit video of her riding an oil pumpjack like a horse, but with barely any clothes on. Needless to say, this shocked political observers, so much so that the San Antonio Express-News (SAEN) editorial board rescinded their endorsement of her. And therein lies our quandary. The SAEN asserts that “it’s an indictment of these times that a candidate would appeal to voters in such a way” when “we expect candidates for public office to model civil discourse.” Point taken. However, it does beg the question; do they not hold themselves to similar journalistic standards? If so, why link the video on their endorsement withdrawal? Clickbait? That’s almost beside the point. Being a father of four daughters, it might make one of us (Baecker) uncomfortable enough if one of the girls posted a “birthday suit” picture on Instagram for their birthday, as Ms. Stogner also did. To so overtly leverage their sexuality for a political campaign would bring on heartburn. It’s a bit hypocritical though, when the SAEN and other media outlets endorse politicians who actually DO whore themselves out to get/stay elected. By self-funding, it’s these very candidates that Ms. Stogner is trying to expose. While she’s using the “assets” she has, others, aided by their media enablers, campaign on giving freebies courtesy of an involuntary donor; the taxpayer. Subsequent redistribution to cronies ranges from the more egregious hand-outs to industries like renewable energy, to tariff-supported trade “losers.” There’s also the more subtle, like assistance nominally intended for the poor. The result is invariably to hook “beneficiaries” on government dependance, tip the scales against other market competitors, and enrich non-value-creating activists. But Sarah Stogner “disgraceful(ly)” lacks “decorum worthy of the public’s trust?” Gotcha. Seasoned politicos were also stunned when Donald Trump got elected, which itself was partly due to his capitalizing on popular anger about this establishment blind-spot. More than one small-L libertarian we know expressly voted for him to “go be a wrecking ball” against it. If Ms. Stogner prevails next Tuesday (this is not an endorsement of her candidacy), or even comes close, it might not be the last time we see someone clad only in pasties and undies if it alerts voters to the real political prostitutes in our midst. They say imitation is the sincerest form of flattery.

Freedom-lovers could be forgiven if they blushed a little when Treasury Secretary Janet Yellen characterized President Joe Biden’s economic policy as “modern supply-side” while speaking to the World Economic Forum recently. The blood then likely rushed out of their faces when they caught a whiff of the exhaust fumes. Broadly speaking, supply-side economics revolves around the ability to produce, free of excessive rules and regulations, and without fear of having subsequent earnings taken by government. It also means that income has solid value, unmolested by currency manipulation. It does not include government as a major player. Granting it an outsized presence is like putting Chris Farley on equal footing with Patrick Swayze at Chippendales tryouts. The state has already damaged the areas Secretary Yellen indicated it wants to bolster. Going back at least a generation to Hillary Clinton’s social demotion of women who “baked cookies” while staying at home with their children, there’s been this assumption that if only there was “affordable” child care, they could achieve more independence by getting a job. Regardless of whether or not elites actually suffer from this delusion, their prescriptions to remedy this supposed problem makes matters worse. First, when they talk about increasing “access,” they typically mean doling out taxpayer-funded assistance. This is in addition to the child-care credits available when we file income taxes. Actual access already exists by virtue of the mere presence of child-care centers/preschools. The very money politicians and bureaucrats throw at it causes prices to rise artificially. Providers see the gravy coming at no direct expense to parents. This phenomenon is also found in education, another area they want to help … more. Plus, the regulations already in place increase compliance costs. If and when this all becomes too much for local operators, the temptation naturally grows to either close their doors, or sell to a larger enterprise. The larger the company, the more ability it has to absorb such costs. The cynic would say politicos are aware of this prospect. Big business is more amenable, and open to the likelihood of the resulting regulatory capture. It secures their position in the marketplace at the expense of the smaller operations they might very well gobble up. Those less cynical give them the benefit of the doubt that they are simply clueless, slim as their experience is in the real world they’re attempting to regulate. Their lofty academic credentials provide them a cocoon of obliviousness. There’s a reason this industry is found in the upper echelon of Mark J. Perry’s inflation graph. Secretary Yellen raises more eyebrows when she claims that “achieving a high topline growth number … is unsustainable.” History says otherwise, as we experienced just such growth during the last two decades of the 20th century, when the economy almost doubled in size. We went out on a bang largely because of advances in computing and the commercialization of the internet. In the eyes of her fellow travelers however, that’s a problem. Citing the “pandemic-induced surge in telework,” hastened by the government shutdowns, she relays a “concern” that “productivity growth” stemming from “technological advancement … may exacerbate, rather than mitigate, inequality.” When translated into policy, this attitude throws a wet blanket on the economy. Just the signal it sends has a dampening effect on the market. The more-rigid economic pie they’re willing to live with might explain why growth was underwhelming the last time they held power. Their policy preferences are self-fulfilling prophecies. In truth, growth this whole century hasn’t been anything to write home about. Compared to the 80s/90s boom, the economy has grown by less than half. One not-insignificant difference between the two periods is dollar policy. Whereas Presidents Reagan and Clinton supported a strong dollar, no president this century has been much more than lukewarm in their stance. Some have outright preferred a weaker greenback. Unfortunately, this doesn’t seem likely to change. When investors become less certain of the value of the return they’ll get, they commit less to growing, newer industries. Fewer, more-efficient machines come along. Productivity stagnates. Instead, they park a greater portion of their resources in safer, already-established assets, attempting to guard against the deterioration of the currency. That’s why the value of something so ordinary as the roof over our heads is susceptible to occasional surges. It’s why we see increasing prices for energy. Incidentally, if “curbing CO2 emissions” is a genuine concern of theirs, they’re on the right path. A weaker dollar is what spurred the fracking technology that unlocked the natural gas that contributed to the precipitous drop in emissions in recent years. Also, it arguably causes less “environmental damage” than the politically popular renewables. Alas, this doesn’t fit the narrative. Viewed in this light, it’s somewhat unsurprising Secretary Yellen looks toward infrastructure (however it’s defined these days) as a new source of productivity. The self-awareness is almost as refreshing as the likely results are depressing. The fact that hardly any pol in D.C. has the courage to slash Uncle Sam’s seizure of private earnings close to the new “global minimum” of 15% all but makes that point irrelevant. Nevermind that the U.S. et al strong-armed other countries to take more from their citizens to get to that level. In other words, actually discouraging them from supplying. The enactment of a Universal Basic Income (UBI) is dependent upon a couple variables. The first is theory.

In a perfect world, a UBI would replace all other federal welfare spending programs. Adults would be given a monthly stipend from the government. Rather than depend on various programs, such as for food aid, health insurance, etc. they would be free to take care of their needs as they see fit, on an individual basis. The bureaucracy that runs and maintains these programs would be folded in favor of a check-cutting operation akin to that of social security. The potential savings could amount to more than half of current federal government spending. There’s also the intangible benefit of a market working more efficiently. In the real world however, the aforementioned savings translate into special interests, starting with 535 federal legislators in the U.S. Congress. In the traditional sense, they’re job is simply to represent their districts’/states’ interests in the federal government, giving voice to a diverse set of American voices from coast to coast, Rio Grande to the Arctic. In reality, with almost $7T in annual spending and 10s of 1000s of pages in the federal register, they’ve morphed into “getting things done” puppets. They need to be seen as dispensing favors to this group or that. If there is less to “do,” or less taxpayer revenue to dole out, they would likely feel useless, unneeded. The prospect is no doubt untenable to some. Then there’s the bureaucracy, staffed with 1000s of civilian employees who have jobs on the line. The inherent nature of government expects less of them given the fact that it will never “go out of business” due to lack of competition, or profit-seeking. That makes it too cushy of a gig to give up without a fight. Finally there are the nominal beneficiaries of these programs, represented most vocally through various lobbying groups. Though those that are actually dependent on federal welfare programs might reasonably be expected to protest the programs’ demise, so would their advocates. The reason for these activists’ 9-5 existence is lobbying not only for these programs’ continuation, but many times their expansion. This is not to exclude all the state and local level agitators reluctant to see the federal gravy train shut or slowed down. One ostensible principle put forth by these factions is that “we’re all Americans, and should therefore take care of each other collectively, from rich states to poor states.” There are yet other, countervailing principles at work. While it’s true that a UBI has garnered support from some conservative corners of the debate, it is predicated on the notion that the responsibilities of the federal government are accepted as-is. Moreover, to one degree or another, it should ‘take care’ of its citizens. Not everyone accepts this precept. Some reject this notion for multiple reasons: recipients do not have to work for it, it comes courtesy of a faceless bureaucracy, it robs them of the incentive to invest in themselves, work, save, etc. Plus, there are multiple non-profit, private charities in that arena, who arguably do as good, if not a better job. These charities are funded by voluntary donations, a fact that could lead to a compromise in the public sphere. The operations of the federal government are largely funded by taxes on income and investment gains. By definition, these levies discourage these optimal, beneficial behaviors. Society progresses, and people flourish, when they work, when they find a match for their passions and/or skills. They are productive. When they save a portion of their disposable income, some of that finds its way into the hands of those of us who have ideas for new or improved products. These flow back into the hands of consumers who then utilize them to make their lives easier, frequently saving them time, which in turn can find its way back into (more) productive ventures. It’s a virtuous cycle … … when unimpeded by obstacles such as taxation. To compound matters, progressive taxation tends to fall disproportionately on those who are most productive (as measured by the marketable value of respective skillsets), more able to save and keep this cycle going. Of the various types of taxation, the ones we’d ideally frown most on are those that disincentivize the behaviors/habits society most benefits from. That leaves consumption. There is the mistaken notion that consumer expenditures “drive economic growth.” This is likely due to how Gross Domestic Product (GDP) is reported. More than two-thirds of it is chalked up to us buying stuff. Consumption is literally the destruction of all that came before it. It’s the end of the production process. Destroying something being labeled as growth is the equivalent to the popular misconception that WWII brought us out of the Great Depression. Alas, we do it. After all, we’re Americans. Part of our trade deficit is due to our preference to buy more than we save (hence the foreign direct investment which fills the gap). We’re going to buy stuff. Only an exorbitant level of sales tax will stop us from doing so. If we want to move forward with a UBI, repealing the 16th amendment is a crucial step. If we want to move forward as a society, the aforementioned government programs would go away with no replacement whatsoever. “Dad, I regret ever introducing you to that show.”

So said my seventeen-year-old recently. Some day she might just accept it, and give me “Great British Bake Off” paraphernalia for my birthday like her sisters did a few weeks ago. She said she’d watch the new season with me, but that has yet to materialize. Oh well. Maybe she’ll join me before the finale drops. Her and her sisters would learn about more than merely baking. Being young ladies today, I would hope the first thing they pick up is a lesson in confidence, something series (“season,” in Brit-speak) 4 finalist Ruby Tandoh sadly, inexplicably seemed to lack. Despite winning “Star Baker” (best overall for an episode) three times, a feat shared by only a handful of other GBBO contestants, she also seemed to shed more tears than any other. She was always doubting herself, approaching judgments “looking forlorn,” as former judge Mary Berry once said to her. Always prefacing with “this is wrong, that’s off,” etc. It’s one thing to hold yourself to high standards. It’s quite another to expect the worst without appearing to hope for the best. It almost defeats the purpose. Why continue on? The anxiety would seem unbearable. A similar mentality weighed on four-time SB and series 10 finalist Steph Blackwell, whose mother implored her to “start believing in herself.” Being so cursed would have crushed the victor of her final, David Atherton. He is the only series champion to never win SB. In fact, he went full Susan Lucci and came in second in the “Technical” (the only challenge unknown to bakers before each episode) five times before eventually winning. Like many contenders over the show’s twelve-year run, he used humor to deal with continually falling short: “Second … again. I repel first.” “Finally got first place. Just eight tries.” Laughing is a much more enjoyable way of dealing with stress than sadness, or anger. There’s enough of that on “Hell’s Kitchen.” After all, baking like this is presumably an escape. For series 9 baker Terry Hartill, it “filled that void” of “massive loss” after his wife died of cancer. In her tearful exit (many are), series 10 alumnus Priya O’Shea recalled how she was “just gonna do the things I enjoy” when she left her job as a marketing consultant. “You can’t go wrong.” Still others simply want to see how they measure up against amateur bakers. As the show grew in popularity, those applicants got better and better. This led, perhaps unsurprisingly, to more plaudits. For series’ 1-7, judge Paul Hollywood extended the coveted “Hollywood Handshake” for a mere eleven bakes. That was nearly matched in series 8 alone. Not only were three given out in the “Signature” one week, but in one “Showstopper,” Hollywood had eventual finalist Steven Carter-Bailey take his place at the judging table due to his “ridiculous”ly good “coloured-bread sculpture.” Then the dam burst. Among the twelve handshakes scattered throughout series 9, an unprecedented two were handed out during the “Cake Week” SS. “I’m disappointed with myself,” Hollywood later quipped. But as he indicated amidst this deluge, when the level of quality is “FAR better,” the praise is proportionate. After adjusting to the new reality, he “raise(d) the bar” for ensuing series’. Bakers would have to “push the boat out” farther. This is all to the better, both in baking and in general. We all benefit when a few in this field or that keep testing the limits of what’s possible. It’s how society progresses, how day-to-day life gets a little bit easier, while freeing up time for these additional pursuits. For GBBO, those floodgates were arguably kicked open by a champion who declared she was “never ever gonna put boundaries on (herself) ever again.” There’s a reason why Nadiya Hussain’s series 6, and its final, were two of the most highly rated, respectively, in the show’s history. For one, Ian Cumming and Tamal Ray joined her to produce arguably the most flawless SS ever. “The best-tasting final we’ve ever had,” as proclaimed by Hollywood, has yet to be eclipsed. But there was also a build-up, as Nadiya struggled early on. While Cumming was racking up SBs (three straight), she was finishing at the back of the pack on Technicals. So surprised she seemed to finally win one in week 5, she waived her hand sheepishly to claim credit. “My kids and my husband are going to be so proud. It’s weird because I’m never proud of myself.” And right she was. After her daughter charmingly listed all the kinds of cakes she liked in the family snapshot of the finale, her husband oozed support and respect for her. It was eminently endearing. When your spouse tells you how “amazing you are,” and how “proud” he is of you, the sky is the limit. He backed it up almost immediately when they moved to the London area where she’s “(made) a career out of” it. She was even asked to make a birthday cake for Queen Elizabeth II. The useful takeaways from this show are endless. It’s not that I don’t watch other things. The girls usually scatter anyway when I put on Maiden or Metallica, or even “Ozark” or “Better Call Saul.” GBBO though, is my anchor show, when I’m winding down for the day or whatnot. The purity of it, the honesty of the participants, the intense competition, the absence of manufactured drama … nothing compares to it. There are many worse ways to kill time. In a recent discussion with a group of principled, politically astute folks, the subject of property taxes came up. More specifically, protesting them. One of them felt it was his duty to do so. Needless to say, there was some animosity in the room.

The topic is oftentimes hotter than the Texas sun this time of year. A few days later, Councilmen John Courage (D9) and Clayton Perry (D10) proposed raising the homestead exemption to 5%, from the current .01%. It was voted down. Our energies are being misallocated here. These anecdotes point to why the whole property tax system should be uprooted and tossed aside. The first problem is with the way it is constructed. While there are various exemptions homeowners can utilize to lower their respective bills, the one the councilmen were trying to increase is the only one available to all. This fundamental unfairness is not without consequences. New district 1 councilman Mario Bravo implied that the city can only afford to “protect senior citizens” with exemptions. That “protection” though, sometimes costs non-senior households four times as much in taxes. If some of the un-“protected” bolt city limits, those who remain face the possibility of a rate hike to make up for the subsequent shortfall. Or, corporate landlords scoop up the abandoned houses, consolidating home ownership in fewer, bigger hands that can easily afford a higher bill. No one would quarrel with helping seniors, or veterans for that matter, the other main beneficiary of current exemptions. Personal contributions to programs run by groups like the United Way, or various religious organizations, or even senior discounts show as much. But picking winners and losers via property taxes breeds resentment, and probably explains why some council members promote workshops to help citizens dispute their bill. However, this contributes to the next point of contention. We certainly don’t begrudge citizens’ efforts to minimize how much government plunders from them. This is especially the case when the tax assessor’s appraised value is out of whack with private market estimates. To their credit, these protesters are arguably more in-tune with the odiousness of this racket than the vast majority who have their mortgage lender escrow it for them. But we wonder if citizens expend the same time and energy objecting to the tax itself. If not, protesting it arguably justifies its existence, and the millions of dollars the county spends to collect it. In practice, the property tax is as detrimental as the income tax. Both disincentivize and erode the ability to save and invest, the sole acts which foster the prosperity we all enjoy. Also, whereas you could lose your freedom for not paying tax on your income, you could lose your home for not ponying up on your property. And the cut for public schools, the only one bigger than that of the city, arguably skews K-12 education. Likewise, given how easy it is to punch up our respective bills, it compromises our privacy. It doesn’t have to be this way. A consumption tax is less distorting, less discriminating, and less intrusive. The first and last gripe you’ll hear about it is that it’s “regressive,” meaning the lower someone’s income, the higher the effective tax they pay when purchasing non-necessities. But that essentially implies that consumers are entitled to that third T.V., or that drum set, or that boat, etc. The second counter-argument is that consumption powers the economy, and therefore we can’t discourage it. That is the height of misinformation perpetuated by the media. Think about it. When you consume something, you literally chip away, or outright destroy the value that it embodied. Consumption ends production. Moreover, you don’t have the former without the latter. If we don’t produce, we don’t consume. An extra $1.50 paid in tax on that sixth pair of $150 shoes could almost make up what the city would lose if it stopped discouraging San Antonians from building wealth. But that hike probably wouldn’t even be necessary. People spend when they’re happy. It’s one byproduct of landing a new job, or getting promoted. Same for the business owner when, after a lot of work and investment, their venture succeeds enough to hire that new employee. It’s a virtuous cycle. They’ve even invented a phrase for shopping sprees when people are sad; “retail therapy.” We’re Americans. We like to buy stuff, so much so that we rent storage space for our extra stuff. That’s not going to change, and can only be enhanced when people don’t feel like they’re being looted involuntarily. Combine that with clearing out some of the regulatory thicket that slows down growth, and rightsizing the expenditure side of the city ledger, and tax rates wouldn’t have to go up on the toys we want. Politicos and entrenched interests will naturally decry this for one reason or another. That’s to be expected since their livelihood depends in part on a misplaced confidence that they can manage citizens’ resources better than they who earned it. We must push them to do the right thing first (abolish the property tax), adjust accordingly, and call them out when they spin it as a false choice between that and “hav(ing) sidewalks.” === Denise Gutierrez-Homer was an interior design and decorative artist for 25 years, is a partner in a family real estate firm, and ran for San Antonio Mayor in Spring 2021. Christopher E. Baecker works in the energy industry, teaches college economics, and ran for city council in the same. She is Vice President of InfuseSA, where he is Policy Director. Concerts are back! It’s the somewhat less exciting news however, that has my attention: so is new music.

My buddies and I are set to see Megadeth/Lamb of God/Hatebreed, and Testament/Exodus/Death Angel, both rescheduled from last year, with bolstered lineups. The mighty Obituary is also going out sandwiched between longtime Ozzy guitarist Zakk Wylde’s Black Label Society, and veterans Prong. One of the last shows I saw before the pandemic was Iron Maiden’s “Legacy of the Beast.” They’re making a noteworthy splash of their own soon: the release of their 17th studio album “Senjutsu.” To say bands like these, still blasting away, are an inspiration would be an understatement. When we see Maiden out supporting “Senjutsu,” drummer Nicko McBrain will be blowing out 70 birthday candles. It’s mind-boggling! A new album is just as impressive to me. When some bands reach this point in their career, they don’t “see a reason” to record new music. Their catalogues are plenty massive to support a week’s worth of unique setlists. And that’s cool. Fans will still pay top dollar to see their favorite tunes played by (mostly) those who recorded them. Moreover, it’s not baseless speculation that “Senjutsu” is no more likely to become part of the Maiden lore than their 2015 effort, “Book of Souls.” From their self-titled debut over 40 years ago, to their masterpiece “Powerslave” a few years later, to the underrated “Seventh Son of a Seventh Son,” it was then, during the 1980s, when fans swooned and became hooked. That bond would survive the departures of vocalist Bruce Dickinson and lead guitarist Adrian Smith, and the rough 1990s that followed. Since both were welcomed back at the turn of the century, Maiden has put out six new albums. Almost 400 years of life amongst the six members hasn’t slowed them down. Nor has cancer on one of the most recognizable set of pipes in all of music. And when they tour, they don’t do so lightly. Not only do they spend months admirably promoting their new albums, they take to the road in ‘off’ years to play nothing but classics. This arguably endears them to their fans. That’s not to dismiss the real possibility however, that new stuff could click with metalheads. The most recent offerings from Metallica and Anthrax for example, are sure to be represented in future concerts. That can’t happen though, without first putting in the effort to write, collaborate, and record. Oddly enough, I’m reminded of my 75 year-old dad. For a decade or so, he and my step-mother have been living an ideal retirement: pulling a 5th-wheel across the country. They also sell RV supplies and accessories along the way. When I asked him about the latter, he told me “I feel like I still have more to give in life.” It kind of made me proud. I’ve never been one who’s had his 62nd or 70th birthday circled on the calendar as the day I’m simply going to stop. Only in the last few years have I found a hobby/side-gig that I would love to do ‘in retirement’ (teaching). It’s clear that social security and Medicare, at the very least, need reform. Nevertheless, we don’t have to tap them and tap out of productive activities at a prescribed time. My dad and my bands inspire me in this regard. Now if I could just get him to appreciate the beauty of a galloping Steve Harris bass line ... What exactly is the San Antonio Express-News editorial board so confused about regarding new guidance on mask-wearing?

The children? Fortunately, they have been the demographic most lightly affected by the coronavirus. If folks who encounter kids are vaccinated, what’s the problem? If they’re not, and they believe in the efficacy of masks, why not just wear one? This includes their own parents. If you think that sounds silly, have I got a doozy for you! Pssst … last year government thought the best way to confront the budding pandemic was to shut Americans in their homes and deprive many of the ability to earn a living to support their families. Crazy, I know. What is “burdensome for businesses?” That they’ll have to create and enforce their own rules? Such varied rules that are bemoaned by proponents of central planning offer the potential for a diversity of information to be had. Better to come to a consensus of millions than a few “experts.” Business owners that are cool with going their own way shouldn’t be subjected to some of their peers’ tendency to enlist the coercive power of the state “level the playing field.” On the other side of the transaction, the customer doesn’t necessarily get to hide behind the façade of “always being right.” I was slightly taken aback recently by maskless patrons at a QT gas station down the road, and equally relieved that the nearby WalMart no longer requires them. However, there are some grocery items that I prefer that WalMart doesn’t have, but that HEB does. As of my last visit, they still require a mask. Fine, so be it. Why is it a stretch for some shoppers to refrain from being boorish about this? Whatever happened to simple civility, especially toward an employee who doesn’t set the rules? If I caught some bitter lout berating one of my daughters working customer service, they might learn that “always being right” isn’t necessarily free of repercussions. What does seem to be immune to consequences here in south central Texas is running a one-sided newspaper. It’s not at all uncommon for editorial sections to lean one way or another. But even the most prominent left-leaning one, The New York Times, has a couple right-leaning contributors. That goes as well for left-leaners at its counterpart, The Wall Street Journal. The same cannot be said of the San Antonio Express-News. Moreover, they’ve long since stopped running even the occasional extended view of anyone who doesn’t reside on the political left, in academia, in non-profits or the like. This extends to the “SA Inc.” section in the Sunday paper. If you didn’t know any better, you’d think activist government is an indispensable, benevolent part of life. In this echo chamber, there are few negative tradeoffs to relinquishing control of our lives, our associations, the fruits of our labor, to a plodding entity subject to no competitive pressure or incentive to give us a sufficient return on our meek consent. This bears the illusion of being the gospel by virtue of entertaining precious little opposition. It’s really no surprise then, when they tell us we “should” get vaccinated. If they had more respect for individual sovereignty, perhaps they would “recommend” instead. If an “honor system” is even worth their mention, that would arguably be a better way to exemplify it. As sure as the sun rises, we can count on a study showing how the economy does better under democrat presidents than republican ones. And so it goes with David Leonhardt in the New York Times recently.

Ever since I’ve been studying economics, one of the most important, recurring precepts is to keep things simple. “As you may have already, and will no doubt see in the future,” I tell my students regularly, “there’s much in real life (politics) that mucks things up.” That said, if my students voted for a bonus class at the end of the semester, where they asked me to elaborate on the government’s effect on the economy, it would go something like this … --- When you pay taxes, a couple explicit things happen, and a couple implicit ones don’t. Every dollar the state takes is one less you have to spend on a good or service someone else worked to create. It’s one less dollar of income for that person or entity. Consequently, she is one step closer to laying off an employee, or going out of business altogether. Or, it is one less dollar you can invest in yourself. It could have been learning to paint or play guitar, or going back to school. Furthermore, it’s one less dollar you have to invest in your own idea for a new product or improvement thereon. It could be someone else’s idea to which you’re one less dollar able to pledge. It could be as simple as your kid’s pet grooming venture, or as big as a Fortune 500 company. It’s one less vote of confidence in an enterprise that has created such value for society that additional employees are needed. It’s a little less business for that machinery company that produces the capital needed to help the booming company’s employees satisfy customers. In the end, it’s one less dollar of a return for you. Instead, that dollar finds a couple different dead-ends. First, it might go toward enlisting the assistance of a tax specialist to ensure you don’t run afoul of the Internal Revenue Service (IRS). For many of us, this can cost more than $100. As importantly, it’s an hour or more not spent with your kids, on hobbies, or more industrious endeavors. And that’s just for us on the demand side. I also emphasize to my students that the supply side is of at least equal importance to market equilibrium. Even though just a handful of us exist there (excluding the labor we supply), it demands the same respect. These folks spend more time and/or money complying with tax authorities. That is many less dollars that could be spent improving their business, hiring additional help, etc. It’s many less dollars they could donate to a scholarship fund, or fewer hours they could spend serving on a school board. Instead, all these resources are vacuumed into the black hole of government, where wealth and productivity go to die. --- There are good people who work in government and the tax compliance industry. But their talents are wasted serving a public bureaucracy not subject to two phenomena that make the private sector hum while generating prosperity: competition and a profit motive. Instead, they’re tasked with turning what’s left of the eroded wealth back out into society, where it deadens, continuously, much of what it comes into contact with. Individual or entity, doesn’t matter. If an enterprise could survive in a competitive environment, it wouldn’t seek any government largesse. Domestically, we see this in the postal delivery industry, and when activists become convinced of the superiority of renewable sources of energy. It’s a cruel irony that their subsidies come courtesy of the taxes paid by their private competitors. It’s poetic justice when the latter prevail anyway, particularly when aided indirectly by activists’ policy preferences in other areas. It manifests itself on the international stage when legacy firms cling to the good ole days at the expense of innovation. Consumers indirectly subsidize this complacency by paying prices that are artificially inflated by tariffs on more efficient competitors. In an increasingly free and interconnected world, they invoke national security, like the steel and aluminum industries. Or, they appeal to base, red-meat instincts like “Buy American,” nevermind the damage done to larger domestic companies that use such resources as inputs. If this welfare sounds like an unfair advantage, that’s because it is. All the favored companies need to do is stay in good with their political benefactors so they continue to tilt the scales. This incentivizes organizational dependency just the same as it does for individuals. One “bold” proposal that made the rounds during the presidential campaign for example, especially among democrats, is financial relief for child care. Some proposed an outright universal entitlement. If this were to go directly to parents, say in the form of beefing up the child care tax credit, they would certainly be able to pay more. It would not be long however, before preschools would raise their prices in order to balance the market. If public options, to borrow a phrase, opened their doors, current operators would be increasingly likely to close theirs, undercut by artificial price ceilings. Throw in social justice warriors’ drive for above-market wages, likely unionization, and Uncle Sam’s deceptively deep pockets, and you have another line item putting pressure on the fiscal budget. Distorted price signals and artificial demand, one way or another, eat away at our earnings. Contrary to what some folks may hope, no law can be passed to prevent any of this. --- My students are not that much older than my teenage daughters. Most of their life has come with rules via parental guidance. No doubt some may wonder why a law can’t simply be created to deal with market shortcomings, real or perceived. When I ask “how do/did you like being restricted by those rules yourself,” they pause for a bit. It’s as desirable to be subjected to them as adults as it was when minors. Only in later years, there is collateral and financial damage that comes with them. This is when it’s especially important that they put themselves in the shoes of suppliers. As youngsters, and sometimes consumers, we don’t feel the brunt of regulation as much. Imagine though, getting a creative spark one day. You discover an idea for something that seems quite useful, or it simply satisfies you in some way. It snowballs from there by delighting your friends and family, some of whom might say “you should try to sell that and make a mint!” Now all you need to do is make sure that no more than 25% of your home is used for this venture. Also, no non-residents can be enlisted to help you, paid or not. At any rate, you can’t make food or fix furniture at home for pay. No music lessons of two or more students, either. You’d also need a license if you want to sell your creation on the move. It might be advisable, and is often suggested, to employ the assistance of an attorney to navigate these, and other requirements. These are a handful of examples at just a local level. Beyond that, and fifty states across the country, there are almost 90,000 pages and over 3,000 rules at the federal level by which Americans must abide. More than simply the monetary and labor costs of compliance, redirected from productive to non-productive purposes, regulations tug at the fabric of the community. When a business has to hire help at a rate in excess of the skill set required, a degree of anxiety is introduced into the equation. That employee may very well work out. Or, they may not, at which point the costly turnover process begins. This only hastens the inexorable drive toward automation. There’s the burden of responsibility shifted from the employee to the employer when the latter must divert potential pay for the former to unemployment taxes. This in turn incentivizes the employee to more frivolous consumption at the expense of diligent savings put aside for a rainy day. To a degree, the employer assumes a paternalistic role as the employee shrinks back toward dependency, as when it is compelled to offer health insurance in the absence of a freer, more flexible market. We forgo the most organic way to weigh on a member of the community if we believe he/she is erring in their business practices; hitting their bottom line by depriving them of patronage. Instead, businesses are caught in a triangular firing squad of onerous regulations, potential lawsuits and bad press. No wonder so few take the dive to start one. --- If elitists in academia, the media and government were truly interested in lifting people up, their best course of action would be to set their models, and hence their egos embedded within, aside. In lieu of that, they could at least give a comprehensive picture with the measurements they cite. I caution my students that, when they read the news, oftentimes there is a gauge in the shadows that is at least as important as the one in the spotlight. The labor force participation rate (LFP), and foreign direct investment (FDI) immediately come to mind. The headline unemployment (UE) rate is the sexy figure that gets all the attention. However, a 5% UE when only 60% of able-bodied adults are in the labor force means 43% of the populace still isn’t working. That 5% UE with a 70% LFP means only a third of people are inactive. As to the latter, the trade deficit (TD), to the extent one exists, is nearly always cast in a negative light. Nevermind that it signals heightened purchasing power, necessarily the result of economic growth (one of the reliable ways to decrease a TD incidentally, is a recession). Part of the reason for that growth is the level of FDI, the counterbalance to the TD. It reflects the fact that investors, domestic as well as foreign, see the U.S. as a most desirable place for their financial capital. If politicians’ scare tactics about the TD work on you, the best way to remedy it is to save more and consume less. Otherwise, enjoy the inexpensive toys that accrue to your work effort. --- Leonhardt is certainly correct when he says “the economy’s performance stems from millions of decisions made every day by businesses and consumers, many of which have little relation to government policy.” That’s why we can’t ascribe too much to one person’s actions, even a president. That said, what a president does, or says, isn’t totally without effect. Perhaps no area is more indicative of his or her utterances than the kind of dollar they want. Reagan and Clinton proved as much. They wanted a stable, even strong dollar, and they got one. As a result, those were the last times we saw authentic economic growth. And they came from different political parties. Attaining genuine prosperity really isn’t all that complicated. It’s an easy story to tell to my daughters and students. Adults would do well to declutter the white noise of politics and keep things simple when attempting to surmise which policies are desirable, and which ones are not. |

AuthorI have worked in accounting for 25 years. I have taught economics to local college students since 2014. I am sending 4 wonderful daughters out into the world. I stay involved in local politics via InfuseSA, and have run for city council in 2021 and 2023. To see where my mind is at, check me out at RealClearMarkets, Mises Wire, The American Spectator, the Foundation for Economic Education, and the San Antonio Express-News, among other. Archives

January 2024

Categories |

RSS Feed

RSS Feed